sales tax in fulton county ga 2019

Some cities and local governments in Fulton County collect additional local sales taxes which can be as high as 19. Based on 31 income tax records.

Georgia Sales Tax Rates By City County 2022

Ad Find HUD Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

. Because Clayton County first levied the 1. Inside the City of Atlanta in both DeKalb County and Fulton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. There are a total of 476 local tax jurisdictions across the state collecting an average local tax of 3683.

The 1 MOST does not apply to sales of motor vehicles. Gwinnett County collects a 2 local sales tax the maximum local sales tax. Fulton County GA currently has 3676 tax liens available as of April 17.

The average salary of Sales Account Executives in Fulton County GA is 79000year based on 31 tax returns from TurboTax customers who reported their occupation as sales account executives in Fulton County GA. Average Sales Tax With Local. The Fulton County sales tax rate is 3.

Georgia has state sales tax of 4 and allows local governments to collect a local option sales tax of up to 4. This is the total of state and county sales tax rates. Sales Tax Breakdown.

In Clayton County the tax rate for motor vehicle sales is 1 less than the generally applicable tax rate. The Georgia state sales tax rate is currently. The Georgia state sales tax rate is currently 4.

For TDDTTY or Georgia Relay Access. The total 775 Fulton County sales tax rate is only applicable to businesses and sellers that are not in the Greater Atlanta area. Top 5 GA Counties by 2020 Sales Tax Revenue The next table shows Georgias top 5 and bottom 5 counties in terms of sales tax growth loss.

Actual Salary and Benefits. Access The Discounted Listing of Cheap Properties. The 10 counties account for 1339 of Georgias total sales tax revenue generation in July 2020 Fulton county accounts for 1276.

Floyd County GA Sales Tax Rate. If your business is based in Atlanta or you sell to customers in Atlanta then the sales tax rate. Has impacted many state nexus laws and.

These buyers bid for an interest rate on the taxes owed and the right to collect back. HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings. Actual Capital and Debt Service.

The 2018 United States Supreme Court decision in South Dakota v. A county-wide sales tax rate of 26 is applicable to localities in Fulton County in addition to the 4 Georgia sales tax. HUD Foreclosed Is the Fastest Growing Most Secure Provider of Foreclosure Listings.

Effective January 1 2019 Code 000 The state sales and use tax rate is 4 and is included in the jurisdiction rates below. Heres how Fulton Countys maximum sales tax rate of 85 compares to other counties around the United States. Ad Find Foreclosed Properties at Huge 50 Savings.

The December 2020 total local sales tax rate was also 7000. This is the total of state and county sales tax rates. The Fulton County sales tax rate is.

Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Fulton County GA at tax lien auctions or online distressed asset sales. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try. Actual Other Operating transfer.

Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. All homeowners age 65 or over qualify for this homestead exemption regardless of income. This exemption applies only to the Fulton County portion of property taxes.

Easy Fast Secure. The Fulton County Georgia sales tax is 775 consisting of 400 Georgia state sales tax and 375 Fulton County local sales taxesThe local sales tax consists of a 300 county sales tax and a 075 special district sales tax used to fund transportation districts local attractions etc. The Gwinnett County Georgia sales tax is 600 consisting of 400 Georgia state sales tax and 200 Gwinnett County local sales taxesThe local sales tax consists of a 200 county sales tax.

Due to renovations at the Fulton County Courthouse. Ad Find Foreclosed Properties at Huge 50 Savings. Additional rate charts and up-to-date changes are available at dorgeorgiagovsales-tax-rates-current-historical-and-upcoming.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. Easy Fast Secure. Ad Do Your 2020 2019 2018 2017 Taxes in Mins Past Tax Free to Try.

The base rate of Fulton County sales tax is 375 so when combined with the Georgia sales tax rate it totals 775. Except when the first Tuesday of the month falls on a legal holiday in which case the sale is held the next business day. If you need reasonable accommodations due to a disability including communications in an alternative format please contact the Disability Compliance Liaison at 404612-9166.

The Fulton County Sheriffs Office month of November 2019 tax sales. Click to see full answer. A tax sale is the sale of a tax lien by a governmental entity for unpaid property taxes by the propertys owner.

Register for 1 to See All Listings. The Gwinnett County Sales Tax is collected by the merchant on all qualifying sales made within Gwinnett County. 445 802 Views.

Fulton County Sheriffs Tax Sales are held on the first Tuesday of each month between the hours of 10 am. Access The Discounted Listing of Cheap Properties. Register for 1 to See All Listings.

26 Votes The minimum combined 2020 sales tax rate for Fulton County Georgia is 89. The current total local sales tax rate in Floyd County GA is 7000. Ad Find HUD Foreclosure Fortunes - Access Our Database Of Foreclosures Short Sales More.

Download all Georgia sales tax rates by zip code. A tax sale is the sale of a Tax Lien by a governmental entity for unpaid property taxes by the propertys owner. Fulton County homeowners over the age of 65 are eligible for a new senior homestead exemption that increases the basic homestead exemption from 30000 to 50000.

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Solid Waste Charges Billing Atlanta Ga

How To Register For A Sales Tax Permit In Georgia Taxvalet

Chevrolet Silverado With 24in Forgiato Gambe 1 Wheels Exclusively From Butler Tires And Wheels In Atlanta Ga Image N Chevrolet Silverado Chevrolet Silverado

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Classic Tax Service Home Facebook

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

W Val Oveson Joins Taxometry As Senior Vice President Send2press Newswire New Technology Paradigm Shift State Tax

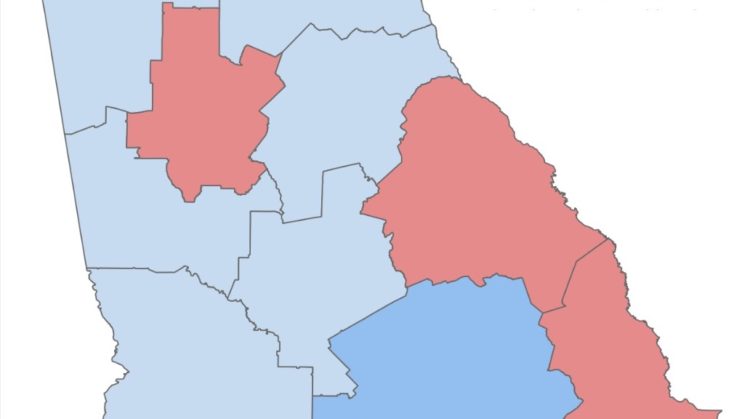

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

Your Guide On Property Taxes In Atlanta Georgia Farkas Real Estate Group

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Reimagining Revenue How Georgia S Tax Code Contributes To Racial And Economic Inequality Georgia Budget And Policy Institute

Sales Tax Collections Plummet At Least 15 In Metro Atlanta In June New Gsu Research Tool Saportareport

Georgia Used Car Sales Tax Fees

Cac Web Ban Hang Trung Quốc Gia Rẻ Order Hang Quảng Chau Quảng Chau Trung Quốc Chậu